China’s TOPCon Cell Prices Strengthen Amid Tighter Policy Oversight

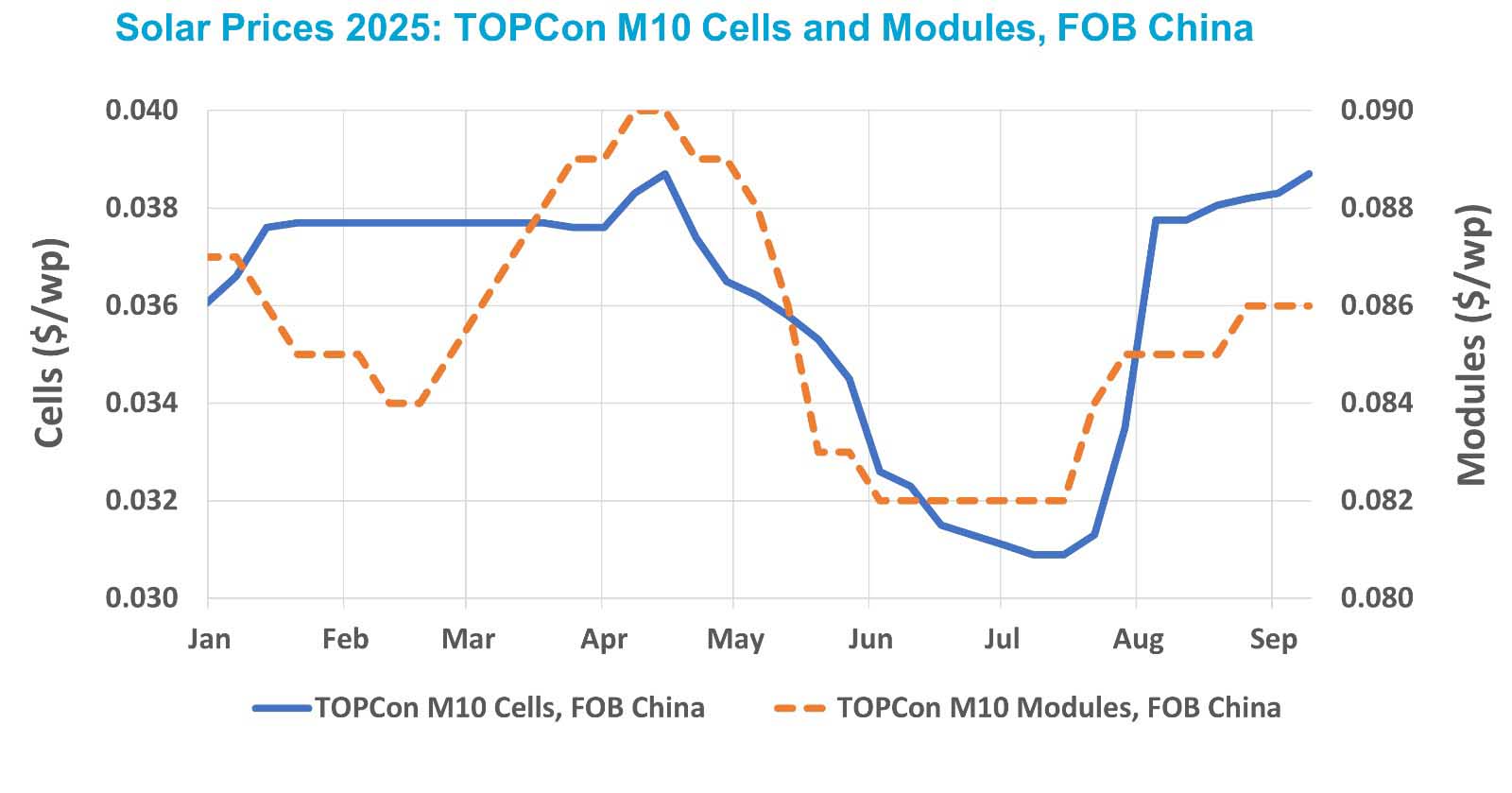

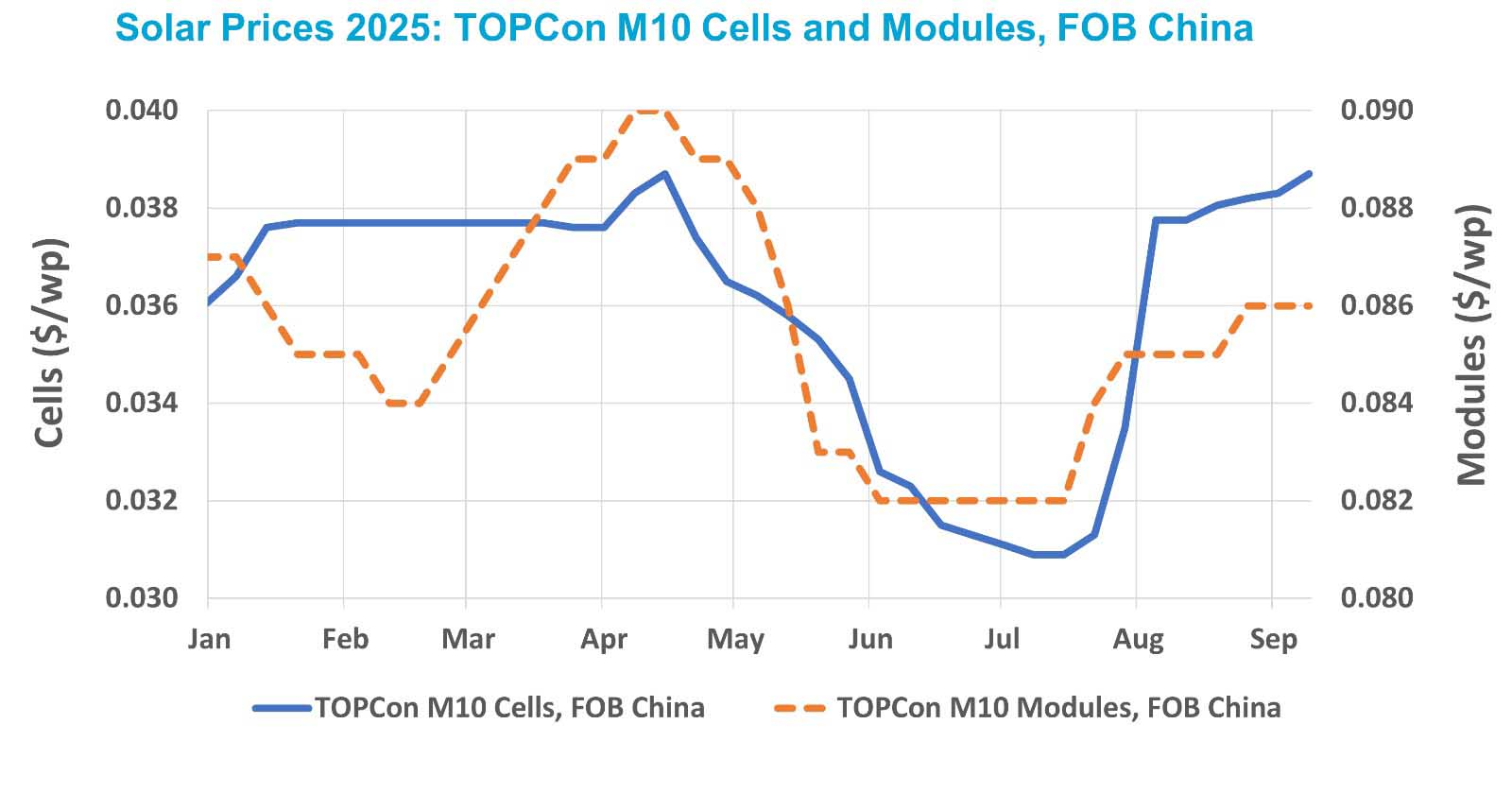

September 12, 2025 – According to the OPIS Global Solar Markets Report, FOB China TOPCon M10 cell prices rose 1.04% this week to $0.0387/W, representing a 24.4% increase since early July’s low. The upward momentum is attributed to expectations of a legally binding module price floor to be introduced in Q4 2025 (approximately $0.098/W, FOB with VAT rebate) and the enforcement of stricter production quotas across the industry.

The China Photovoltaic Industry Association (CPIA) has intensified regulatory oversight, recently directing a leading manufacturer to reduce output after exceeding its quarterly quota. These measures align with the newly released 2025–2026 Action Plan from MIIT and SAMR, which seeks to prevent excessive capacity expansion, stabilize pricing, and drive high-quality growth across solar photovoltaics, component manufacturing, and related sectors.

Despite stronger policy support, cell producers continue to face significant margin pressure. Rising wafer and polysilicon costs are colliding with weaker downstream demand, high inventory levels, and stagnant module prices. Market activity, which temporarily surged in August on speculation of changes to China’s export tax rebate, has since returned to normal levels.

Summary: China’s TOPCon cell prices are rebounding on the back of looming price floors and tougher quota enforcement, yet manufacturers remain challenged by rising input costs and sluggish downstream dynamics.