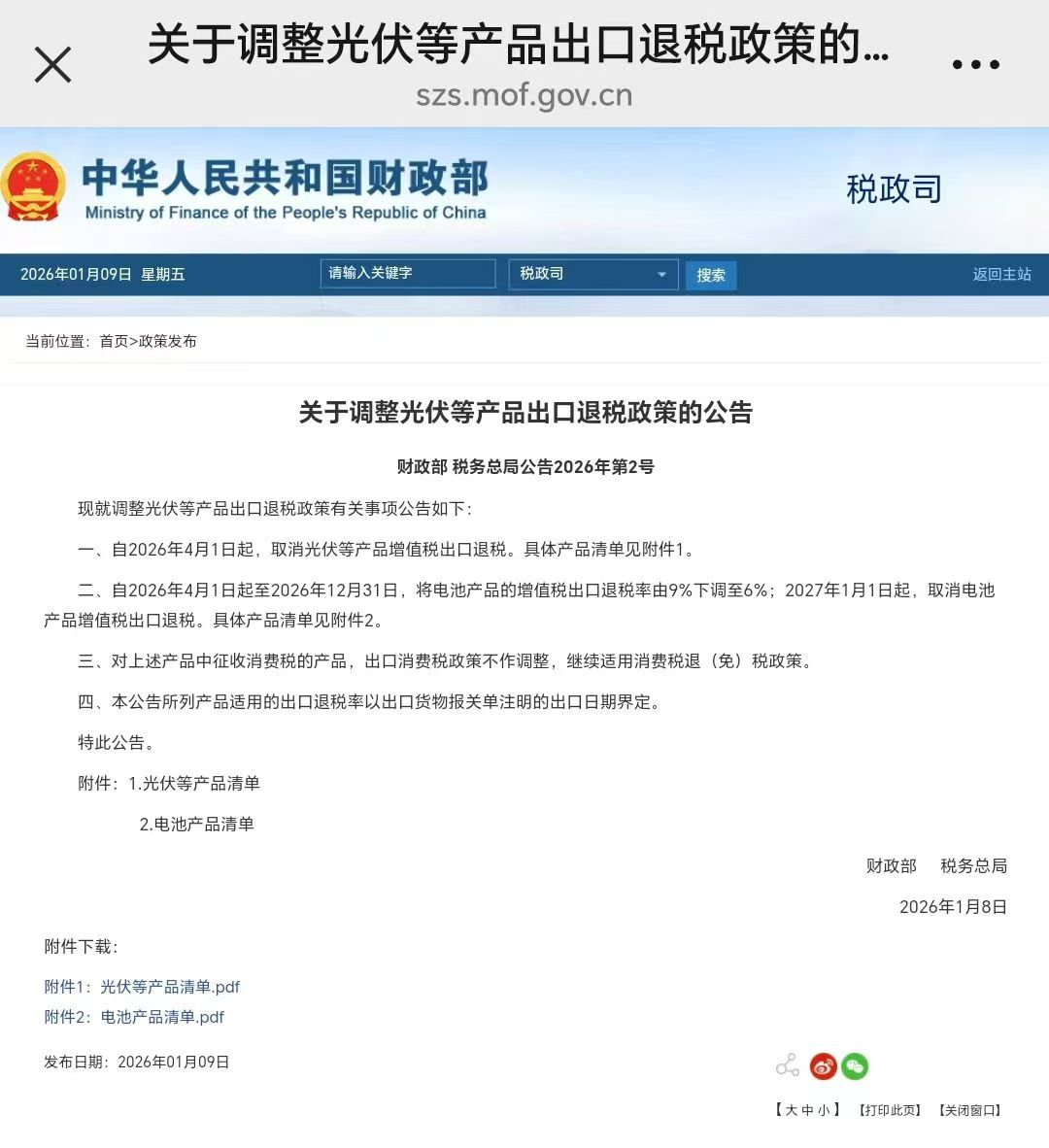

Announcement on Adjusting the Export Tax Rebate Policy for Photovoltaic and Other Products

Announcement No. 2 [2026] of the Ministry of Finance and the State Taxation AdministrationMatters concerning the adjustment of the export tax rebate policy for photovoltaic and other products are hereby announced as follows:

1. As of April 1, 2026, the VAT export tax rebate for photovoltaic and other products will be cancelled. For the specific list of products, see Annex 1.

2. From April 1, 2026 to December 31, 2026, the VAT export tax rebate rate for battery products will be reduced from 9% to 6%. As of January 1, 2027, the VAT export tax rebate for battery products will be cancelled. For the specific list of products, see Annex 2.

3. For products subject to consumption tax among the above products, the export consumption tax policy will remain unchanged, and the consumption tax refund (exemption) policy will continue to apply.

4. The export tax rebate rates applicable to the products listed in this announcement shall be determined by the export date specified on the export customs declaration.

Issued by:

Ministry of Finance

State Taxation Administration

January 8, 2026